Accounts Receivable Outsourcing Services for U.S. Companies

Accounts Receivable outsourcing services help U.S. companies speed up collections, reduce DSO, and maintain healthy cash flow by delegating invoicing, reminders, collections, and cash application to trained AR specialists. Outsource Work provides dedicated Ukrainian Accounts Receivable professionals who manage full-cycle AR operations inside your systems at up to 70% lower cost than hiring locally.

Accounts Receivable

Accounts Receivable

What Are Accounts Receivable Outsourcing Services?

Accounts Receivable Outsourcing Services help companies manage the full AR lifecycle, including invoicing, customer communication, reminders, collections, cash posting, and dispute handling.

This is used by U.S. companies to:

Reduce overdue invoices

Improve cash flow

Lower DSO

Reduce workload on internal finance teams

Maintain consistent customer follow-up

An AR outsourcing company provides trained AR specialists who execute your AR workflow using your systems.

Why Accounts Receivable Is Critical for U.S. Companies

Cash flow is the single biggest factor behind small-business closures in the United States - not lack of profit, but lack of timely cash collection. When invoices aren’t followed up consistently, payments slow down, DSO increases, and working capital dries up.

Professional accounts receivable outsourcing services help prevent this by strengthening every step of the AR cycle. With a dedicated remote AR specialist, U.S. companies improve cash flow without expanding payroll.

AR outsourcing improves performance by:

Maintaining consistent, timely follow-ups

Managing collections with a professional, customer-friendly approach

Resolving disputes faster and reducing outstanding balances

Ensuring invoices are accurate and delivered on time

Posting payments and reconciling accounts without backlog

A well-managed AR function directly increases liquidity, strengthens the balance sheet, and supports predictable growth.

👉 Explore our Accounting & Bookkeeping Services to reduce operating costs by up to 70%.

Included Accounts Receivable Outsourcing Services

Your AR package includes end-to-end processes supported by experienced professionals

Invoice Management

Creation, delivery, and dispute resolution.

Cash Application Services

Payment matching, reconciliation, and reporting.

Collections Outsourcing

Friendly follow-ups, aging analysis, missed payment alerts, and escalations.

Customer Communication

Email, phone, CRM tracking, and status updates.

ERP & System Integration

We integrate into QuickBooks, NetSuite, Sage, Xero, Zoho and more.

Dedicated AR Outstaff Team

Full-time specialists who function as part of your company.

AR Reporting & Forecasting

Aging reports, cash flow forecasts, and KPI dashboards.

Benefits of Accounts Receivable Outsourcing

Partnering with a professional AR team delivers several advantages:

Cost Reduction

You can save 50–70% by switching to Ukrainian-based AR BPO services.

Faster Payments

Better follow-up processes help reduce DSO outsourcing and improve cash flow.

Scalable Workforce

You can easily add more remote AR specialists during busy periods.

Higher Accuracy & Fewer Errors

Skilled AR staff ensure proper documentation, reconciliation, and communication.

Better Customer Experience

Professional collections maintain good relationships, unlike automated reminders.

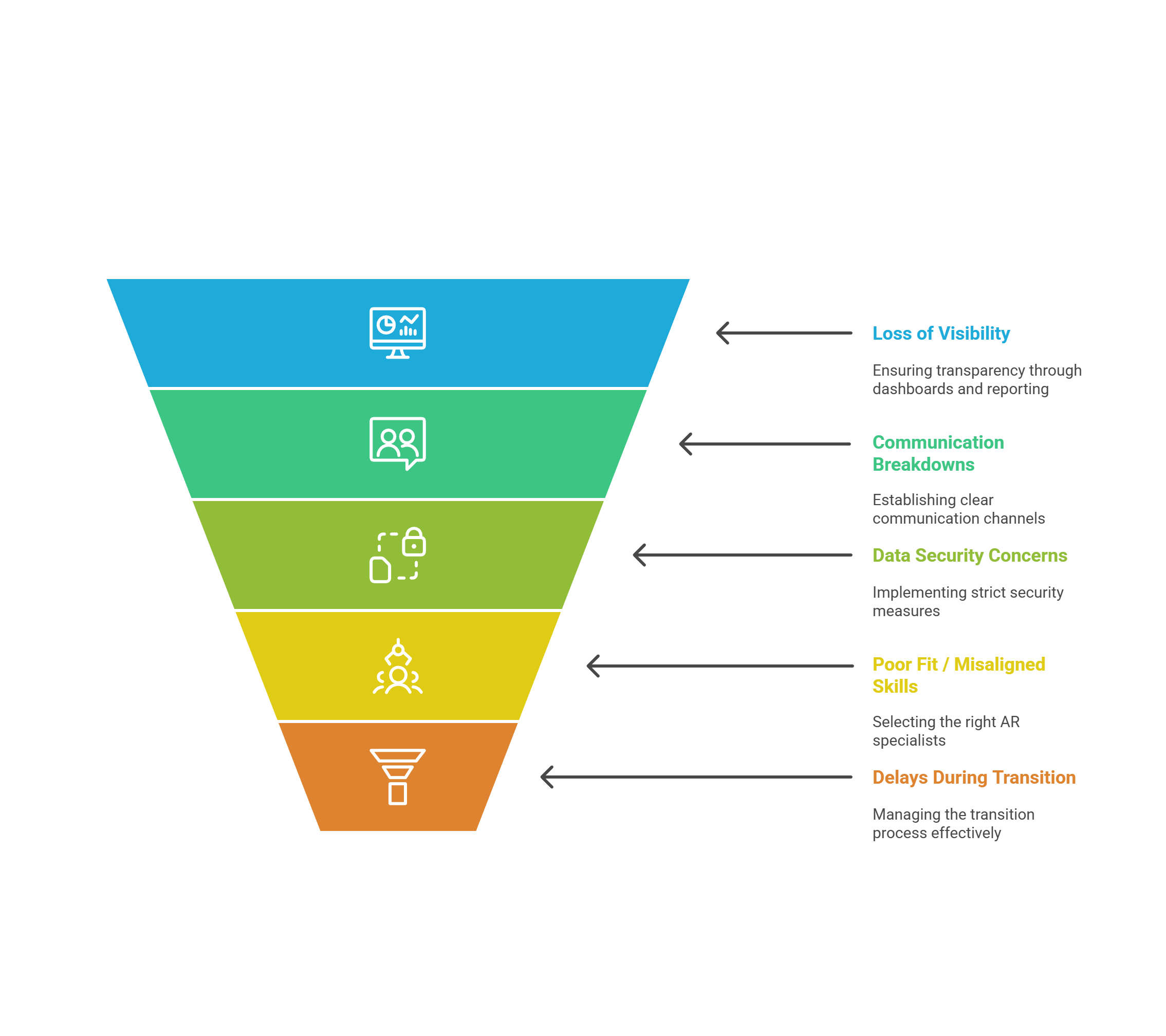

Risks & How to Mitigate Them

While accounts receivable outsourcing services offer major advantages, it’s important to understand potential risks and how to avoid them:

1. Loss of Visibility Over AR Process

Mitigation: Use shared dashboards, regular reporting schedules, and integration with your ERP so you maintain full transparency.

2. Communication Breakdowns

Mitigation: Work with a provider offering dedicated remote AR specialists, daily standups, and documented SOPs.

3. Data Security Concerns

Mitigation: Choose accounts receivable companies that follow strict access controls, NDA policies, and GDPR/ISO compliance.

4. Poor Fit / Misaligned Skills

Mitigation: Select a partner that allows you to interview and hire AR specialists directly before onboarding.

5. Delays During Transition

Mitigation: Use a phased migration plan with clearly defined deliverables and real-time monitoring.

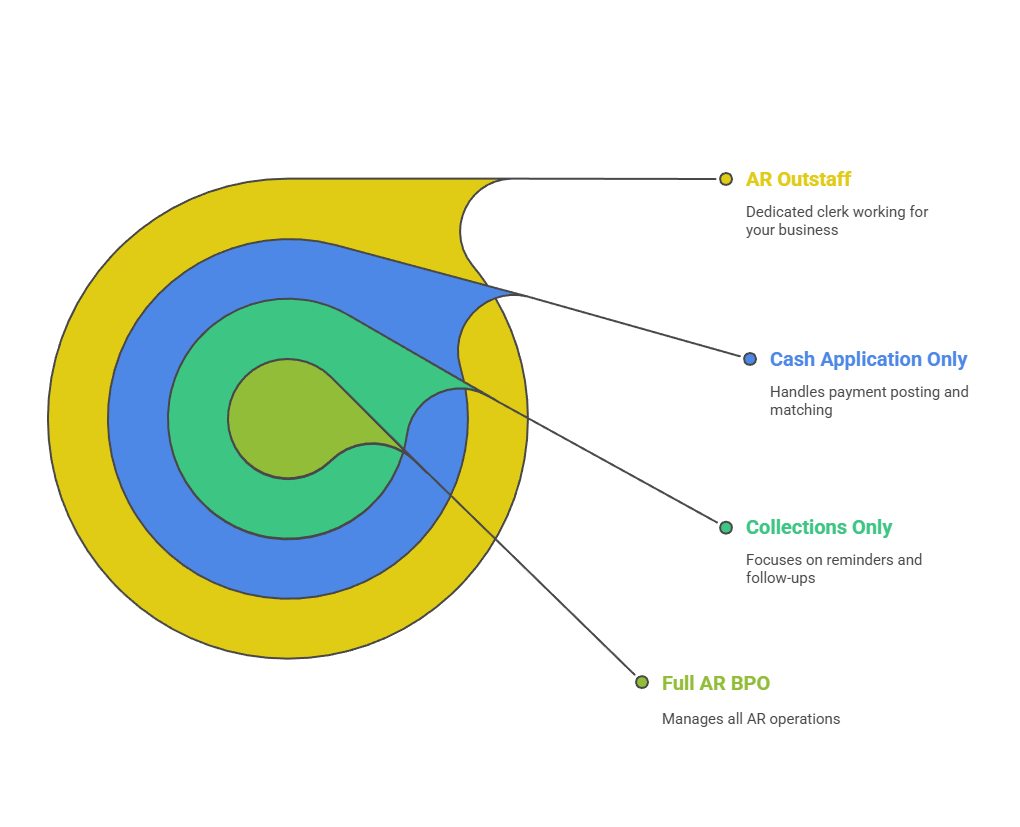

AR Outsourcing Models

1. Full AR BPO Model

We manage all AR functions (invoicing, collections, reporting). Best for companies wanting full accounts receivable services without managing internal staff.

2. AR Outstaff Model

You get dedicated accounts receivable outstaff specialists who work exclusively for your company but remain on our payroll. Ideal for teams needing flexibility.

3. Hybrid Model

Outsource some tasks (like cash application services or collections outsourcing) while keeping strategic decisions in-house.

4. Project-Based AR Support

Short-term AR help during high-volume periods or backlog cleanup projects.

How to Choose an AR Outsourcing Company

✔ Technology & Integrations

Your provider should support QuickBooks, NetSuite, Sage, Xero, Zoho, or your custom ERP.

✔ Reporting & KPIs

Ask how performance is measured after you outsource accounts receivable.

✔ Customer Support & Communication

Daily updates, shared communication channels, and a dedicated account manager.

✔ Technology & Integrations

Your provider should support QuickBooks, NetSuite, Sage, Xero, Zoho, or your custom ERP.

✔ Reporting & KPIs

Ask how performance is measured after you outsource accounts receivable.

✔ Customer Support & Communication

Daily updates, shared communication channels, and a dedicated account manager.

Implementation Roadmap

A clean and structured rollout ensures high performance from day one.

Step 1 - AR Process Audit

We review your invoicing workflow, DSO drivers, reporting, and collections process.

Step 2 - Define Scope & KPIs

We outline responsibilities, systems access, reporting cadence, and escalation rules.

Step 3 - Candidate Selection

You interview and hire AR specialists through our AR outstaff recruitment process.

Step 4 - Training & Knowledge Transfer

We document SOPs, communication workflows, and system permissions.

Step 5 - Go Live & Testing

Your AR team begins handling daily tasks with real-time monitoring.

Step 6 - Continuous Optimization

We adapt processes to help you further reduce DSO and improve cash flow.

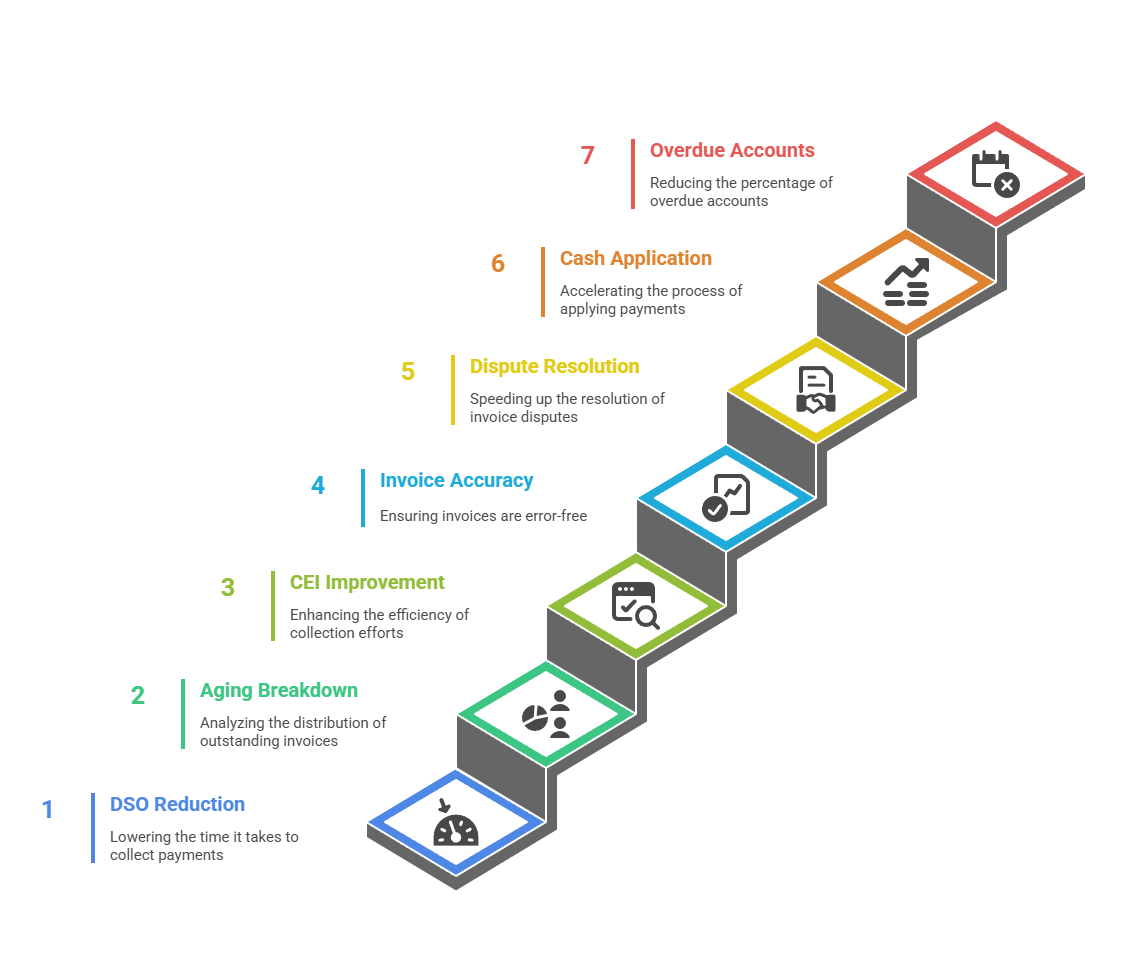

Key KPIs to Track After Outsourcing

Tracking performance after you outsource accounts receivable is crucial. Metrics include:

DSO (Days Sales Outstanding) - key indicator for reduce DSO outsourcing initiatives

Aging Breakdown (0–30 / 31–60 / 61–90+)

Collection Effectiveness Index (CEI)

Invoice Accuracy Rate

Average Days to Resolve Invoice Disputes

Cash Application Speed

% of Overdue Accounts

These KPIs help ensure your accounts receivable outsourcing services deliver measurable improvements.

Pricing

Our billing is based on the hourly rate of your custom team members, starting at $9 per hour and Monthly Fixed Fee.

You receive one monthly invoice from OW.

Outsource Work internally manages all aspects of employee salaries, taxes, and other necessary formalities.

$1,500/month per contractor (1-3 years experience)

$1,700/month per contractor (4+ years experience)

Monthly Fixed Fee per contractor $500

Our Staffing Process Step by Step

Opt for flexibility and watch your business growing faster.

Now

Day 1

Day 2

Day 5

Day 8

Day 12

Day ∞

Contact us

We check your needs and timelines.

Discovery call

We gather all the details of your request.

Search launch

Our recruiters launch the hiring campaign.

Review candidates

We present you with the most suitable candidates.

Interviews

Together with your hiring managers, we go through all interview stages.

Hire & onboard

We hire talent for you and fully onboard them.

Talent management

We support your team with all HR onward.

What roles can you outsource with Outsource Work?

Outsource Work is the leading Accounts Receivable recruitment in Ukraine, building full-time, dedicated teams for its clients while taking care of everything on the ground.

❓ FAQ: Outsource Accounts Receivable

-

Outsourcing accounts receivable means hiring a third-party service provider to manage invoicing, payment collection, and customer follow-up on your behalf. It improves efficiency and cash flow while reducing internal workload.

-

Businesses outsource AR to reduce operating costs, accelerate collections, and improve accuracy in financial reporting. It also allows teams to focus on core operations rather than administrative tasks.

-

Yes, accounts receivable is classified as a current asset on a company’s balance sheet because it represents money owed by customers for services or goods already delivered.

-

The aging method categorizes unpaid invoices by how long they have been outstanding. It helps businesses assess the likelihood of collection and monitor customer payment behavior.

-

Collection strategies vary by provider but typically include invoice reminders, follow-up calls, and escalation to formal collection agencies if necessary - all done professionally to maintain customer relationships.

-

Yes, many BPO companies offer bundled solutions that include both AP and AR management. This creates a seamless, integrated finance operation with fewer errors and lower administrative costs.

-

Key benefits include faster collections, better cash flow, fewer overdue accounts, scalability, and access to experienced accounts receivable staff without hiring internally.

-

Costs vary by provider and service scope but are generally more affordable than building an in-house AR team - especially with offshore or nearshore options.

-

Yes, most modern AR providers can integrate with platforms like QuickBooks, Xero, NetSuite, and others to ensure real-time reporting and data consistency.

-

Look for a provider with industry experience, clear reporting practices, positive client reviews, and flexible service models that align with your business goals.

-

AR outsourcing includes invoicing, reminders, collections, cash application, and dispute management performed by trained AR specialists.

-

Most AR outsourcing services cost $1.50–$8.00 per invoice or $22,000–$45,000 per year for a dedicated AR outstaff specialist.

-

They send invoices, follow up with customers, handle collections, apply cash, and resolve disputes to reduce DSO.

-

AR outstaff provides a dedicated remote AR specialist who works directly for your business while the provider handles payroll and HR.

Want to Get the Accounts Receivable Specialist?

📞 Contact Us Today

📧 Email: serhii@outsource-work.com

📱 Phone: +37253761133