10 Financial Management Tools to Use in 2025

📅 05.29.2025 | ⏱️ 13 min read

📉 Why SMBs Need Financial Management Tools More Than Ever

Around 40% of small businesses carry over $50,000 in debt, and 13% owe more than $500,000. That debt can either growth - or capsize your business. 🧊

As a founder, you’re juggling multiple roles - launching, hiring, selling - and spreadsheets can feel like quicksand. With the right financial tools, you can save time, make better decisions, and sleep better at night. 😴

In this guide, we’ll break down the top 10 financial tools that SMBs and startups are using in 2025. Whether you're looking for basic bookkeeping, cash flow forecasting, or full FP&A, we’ve got you covered.

💼 10 Best Financial Management Tools in 2025

1. Outsource Work

Outsource Work is an all-in-one staffing agency that combines automation with expert financial support. It helps small businesses create accurate forecasts, track performance, and manage their entire financial strategy in one place.

Instead of juggling spreadsheets and multiple apps, you get a single dashboard that updates in real time - and real financial professionals who act like your remote CFOs.

Features:

Financial statements – Profit and loss, balance sheet, and cash flow statements

Custom dashboards – Track KPIs that matter to your business

Unit economics – CAC, LTV, and conversion insights

Forecasting – Baseline and growth projections

Plan vs actuals – See how you're tracking against goals

2. Datarails

Datarails is built specifically for SMBs that want FP&A functionality inside Excel. It helps you consolidate, forecast, and build reports without manual spreadsheet merging.

Datarails features

Customizable dashboards: Users can choose to display financial data on dashboards either in table format or through visual elements like graphs and charts.

Scenario analysis: Teams can perform “what-if” analyses, running different financial models to predict the effects of decisions or external factors on the company’s finances.

Forecasting: Datarails’ forecasting feature enables businesses to plan costs and revenues according to projections.

Integrations

Datarails integrates with business intelligence tools like Power BI and Tableau, CRMs like HubSpot and Salesforce and accounting tools like Xero and QuickBooks. These integrations help centralize data and access all insights in one place.

3. Pigment

Pigment is an intuitive business planning tool that emphasizes visual reporting and collaboration. It’s a great pick for cross-functional teams managing finance, HR, and ops.

Pigment features

Dashboards and reports: Pigment lets businesses design dashboards and reports using visuals like bar, waterfall and org charts.

Collaboration tools: Teams can collaborate through comments and notifications to stay aligned.

Scenario planning: Pigment helps finance teams simulate different business scenarios. This allows them to analyze potential changes and prepare for future events.

Integrations

Teams can connect Pigment to ERP and accounting software like NetSuite and Sage Intacct to get a unified view of their data. The platform can also sync with data management tools like Snowflake and Azure SQL to ensure teams work with up-to-date information.

Best for:

Teams that want high visibility and easy modeling with a modern UI.

4. Cube

Cube is a lightweight FP&A solution that connects to spreadsheets and source systems. It’s great for finance teams who love Excel but need more automation and better version control.

Cube features

Multi-scenario analysis: Companies can use this scenario planning software to compare financial scenarios by adjusting assumptions and seizing potential changes.

Access control: Cube provides the ability to control who can access financial data based on their user role.

Report templates: This platform includes customizable templates for financial planning, including templates for capital expenditures, budget vs. actual comparisons and financial calendars.

Integrations

Cube connects with CRM tools like Hubspot and Salesforce. Businesses can also connect it to QuickBooks, Power BI and Databricks to optimize financial planning, data visualization and advanced analytics.

5. Anaplan

Anaplan is a robust enterprise-level solution for financial and operational planning. It includes a powerful modeling engine and is often used by large teams for integrated business planning.

Anaplan features

Anaplan Intelligence: Anaplan AI-driven financial management tools - CoPlanner, PlanIQ and Optimizer - assist finance teams in answering questions, forecasting trends and identifying optimal strategies to enhance financial management.

Capital planning: Businesses can use “what-if” analysis and automated variance tracking to efficiently manage financial resources in capital planning

Chat Bot: Businesses can use the Anaplan Chat Bot via Slack to ask questions and issue commands.

Integrations

Anaplan connects with CRM tools like Salesforce and data management platforms like Tableau. It also supports Power BI integration for better data visualization. Anaplan offers APIs that let teams connect with other tools they use.

Best for:

Enterprises and large teams managing multi-department budgets.

6. Planful

Planful automates accounting and finance management. It uses AI to offer real-time insights into an organization’s financial health and cost performance. Its predictive analytics highlights potential financial trends.

Businesses can create custom dashboards with Planful’s drag-and-drop tool. Users can drill down into detailed data or zoom out for a broader view. This ensures key insights are clear without juggling multiple chart versions.

Planful features

Data centralization: Planful integrates business data from ERPs and spreadsheets into one unified view.

Machine learning (ML)-driven projections: The software analyzes past data to create forecasts and assists teams in planning budgets and next steps.

AI-powered anomaly detection: Teams receive AI anomaly detection alerts that flag risks, errors and outliers in financial figures.

Integrations

Businesses can integrate Planful with CRM platforms like Salesforce, ERP tools like Oracle and accounting software solutions like QuickBooks. This way, Planful merges financial data, operational insights and customer information for more informed financial decision-making.

Best for:

Mid-sized teams wanting robust FP&A functionality with collaboration tools.

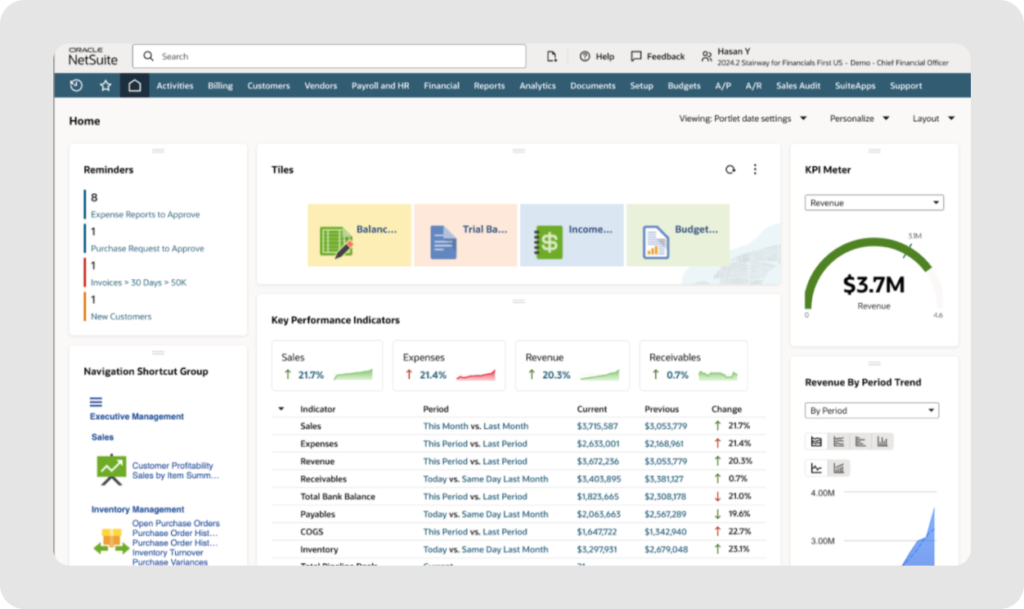

7. NetSuite Planning and Budgeting

NetSuite Planning is part of the Oracle ecosystem. It connects natively to NetSuite ERP and supports full-scale budgeting and forecasting.

NetSuite features

AI-powered predictive planning: NetSuite uses AI to analyze past data and predict future trends.

Expense tracking: This tool allows for employee expense management, allowing users to submit receipts and route them for approval.

Pre-built templates and workflows: Teams can use pre-built templates and workflows to simplify company-wide and departmental budgeting.

Integrations

The NetSuite Financial Management tool works within the NetSuite environment. It also offers the NetSuite Connector, a paid add-on. This connector lets businesses link their point-of-sale systems, Shopify POS or Oracle Simphony POS, so sales and payment data syncs directly with NetSuite. It can also connect to Salesforce CRM to sync financial data between both systems.

8. Vena

Vena combines FP&A with Excel workflows and adds a layer of automation. You still work in Excel, but the tool connects to your financial data and tracks everything in the background.

Vena features

AI-powered insights: Vena offers AI predictive analytics and anomaly detection to help businesses identify inefficiencies and trends in financial management.

Budgeting: Businesses can use flexible budgeting approaches like top-down, bottom-up and zero-based methods.

Workflows: Vena helps create workflows and automate tasks like sending reports, setting reminders and budget approval processes.

Integrations

Vena integrates with Sage Intacct, Oracle and Microsoft 365 tools, as well as QuickBooks. These integrations help automate data collection, reporting and forecasting.

Best for:

Finance teams who want to modernize Excel-based planning.

9. Xero

Xero is a popular cloud-based accounting solution used by small businesses and accountants worldwide. It’s ideal for simple financial management and integrates well with other tools.

Xero features

Multi-currency accounting: Xero automatically converts currencies and tracks exchange rates in real time. It also allows companies to invoice international customers in their local currency.

Data capture via Hubdoc: Xero integrates with Hubdoc to automatically capture key data from invoices, receipts and bills.

Invoicing tools: Teams can create and send invoices directly from the software.

Integrations

Businesses can extend Xero’s functionalities with integrations like eCommerce platforms such as Shopify, the marketing tool Mailchimp and the project management platform Accelo. This way, they can further optimize operations and see all business data in one place.

10. Expensify

Expensify simplifies expense tracking for both employees and finance teams. It uses receipt scanning and automation to streamline reimbursement workflows and syncs with your accounting software.

Expensify features

Entry categorization: Expensify automatically categorizes transactions into groups like fees and office supplies. Teams can also create custom categories.

Invoicing: The invoicing feature automatically handles tax preparation, calculating taxes, fees and discounts to create accurate invoices.

Bill pay: Businesses can process billing and payments in Expensify by capturing bill details and automating payment processes using SmartScan.

Integrations

Expensify offers HR platform integrations like Gusto and Deel, accounting software like Xero and QuickBooks, and receipt integrations with companies like Uber and Delta. This helps businesses access and manage data from various sources and automate tasks like reporting and payments.

Best for:

Teams that need an easy, automated way to track employee expenses.

📊 Comparison of Financial Management Tools for SMBs (2025)

| Platform | Key Features | Best For | User Rating |

|---|---|---|---|

| Outsource Work | Financial statements, dashboards, unit economics, forecasting, plan vs actuals | Startups, founders, and SMBs needing clarity + remote CFO support | ⭐⭐⭐⭐⭐ |

| Cube | Scenario planning, access control, report templates, Excel integration | Finance teams sticking with spreadsheets but needing automation | ⭐⭐⭐⭐½ |

| Datarails | Custom dashboards, scenario modeling, forecasting, Excel-native | Excel-heavy teams needing real-time updates and insights | ⭐⭐⭐⭐½ |

| Pigment | Dashboards, collaboration tools, scenario planning, visual UI | Cross-functional teams that value planning and UX | ⭐⭐⭐⭐½ |

| Anaplan | AI forecasting, capital planning, Slack bot, enterprise modeling | Enterprises and large organizations with complex budgeting | ⭐⭐⭐⭐⅓ |

| Planful | Data centralization, ML projections, anomaly detection, dashboards | Mid-sized teams wanting full FP&A collaboration tools | ⭐⭐⭐⭐⅓ |

| Vena | Excel-based planning, predictive AI, budget workflows | Teams using Excel that need visibility, automation, and growth | ⭐⭐⭐⭐½ |

| NetSuite Planning | ERP integration, AI planning, expense tracking, budgeting templates | Companies already using Oracle NetSuite ERP | ⭐⭐⭐⭐ |

| Xero | Multi-currency, Hubdoc receipts, invoicing, real-time tracking | Small business owners and accountants | ⭐⭐⭐⭐⅖ |

| Expensify | Receipt SmartScan, entry categorization, bill pay, tax automation | Teams needing simple, automated employee expense tracking | ⭐⭐⭐⭐⅖ |

Ready for Financial Peace of Mind?

If you're tired of juggling spreadsheets and want a clearer view of your business’s finances, it’s time to upgrade.

With Outsource Work, you get the clarity of top-tier financial tools - plus expert support, outsourced staffing, and remote financial professionals who operate as part of your team.

✅ Start here – Get your free quote

✅ Explore our Outsourced Bookkeeping Services

✅ Hire Remote Finance Talent

❓ FAQ

What is a financial management tool?

It’s software that helps businesses manage money, generate forecasts, plan budgets, and track financial performance.

Which tools do small businesses use most?

QuickBooks, Xero, and spreadsheets are common - but many are upgrading to platforms like Outsource Work for automated insights and expert guidance.

How is Outsource Work different?

It’s more than a tool - it’s a remote financial department. You get dashboards, forecasts, and real financial experts who help you scale profitably.

How much does Outsource Work cost?

Pricing starts at $1,500/month per contractor. We also offer flexible staffing solutions with no lock-in contracts and full transparency.